Overview

Our client is a business partner of a leading finance and accounting firm in the USA.

Business Need

Our client realized that there were many intensive manual processes present in their accounts payable department. For example, for a general account entry in the ERP, the executive needs to open the mailbox, find payments related Emails with attached invoices, download them and access the details. Even, this time-consuming task leads to lower data throughput and in turn, poor productivity. Additionally, more human intervention in accounting data entry leads to number accuracy concerns. So it became very important for our client to implement RPA in finance and accounting processes and gain a competitive edge with digital transformation.

Client Situation

Our client wanted to implement a RPA Solution to automate their finance and accounting processes. The main aim of this RPA platform development was to lower down the financial process related challenges and improve productivity through financial process automation.

Technologies

RPA Tools / Platform: UiPath

- RPA execution infrastructure setup

- Web and Desktop software setup/integration

- RPA Processors configuration

- RPA Execution Orchestration configuration

- Software Bots configuration

- RPA Logs/Analytics configuration

- SalesForce integration

- Version Control integration

Recommended Solution

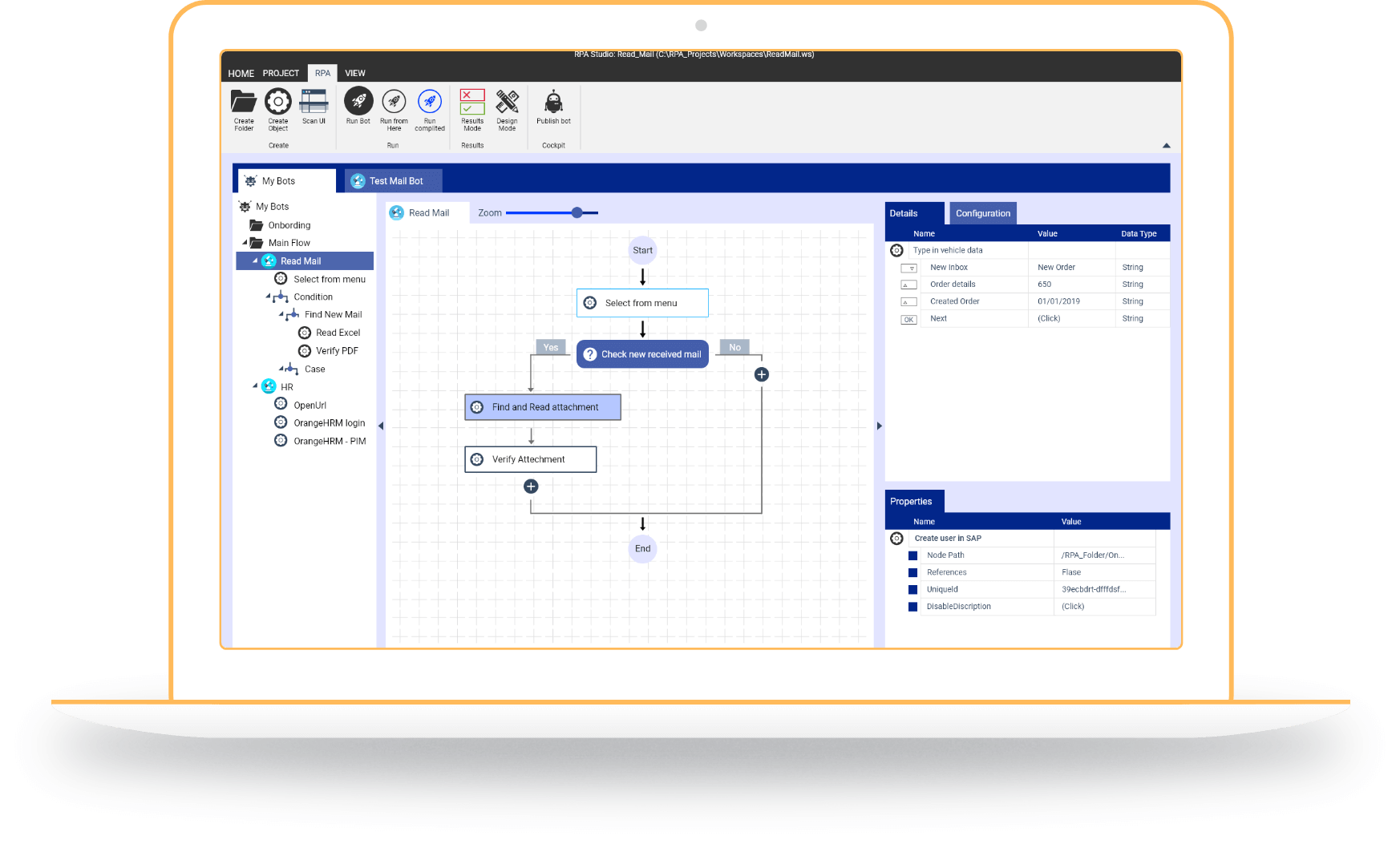

With our team of RPA developers, we analyzed all the financial and accounting processes used by our client and identified major areas for implementing process automation using robotic process automation tool. Processes were categorized under parameters such as RPA Tool selection, cost of RPA development, ease of use in actual scenario, information security & accuracy, RPA integration with their existing system, cognitive automation capabilities, and many more.

RPA bots were developed so that it provided higher ROI to our client. Our RPA developers implemented different Digital Workers for repetitive manual processes like open an Inbox, navigate various Emails, extract unprocessed Invoices, access details, open ERP tool, and auto submit corresponding data and accordingly notify through an Email with success/failure message. We also ensured RPA BOTs performs well in both, the Staging and Production environment and there are no differences in the UI/UX, access level, etc.

RPA bots were developed so that it provided higher ROI to our client. Our RPA developers implemented different Digital Workers for repetitive manual processes like open an Inbox, navigate various Emails, extract unprocessed Invoices, access details, open ERP tool, and auto submit corresponding data and accordingly notify through an Email with success/failure message. We also ensured RPA BOTs performs well in both, the Staging and Production environment and there are no differences in the UI/UX, access level, etc.

Implementation of Key Features includes:

- Automated Interactions via screen scraping & API integration with AWS Cloud, Excel, IE, and Citrix.

- Improved decision making via Cognitive Intelligence

- Simple interface to create RPA Bot quickly

- Enabling dynamic up-scaling/down-scaling of the RPA Bots

- Convert scanned attachments into actionable Invoice data for further process

- Automatic mining all Invoice records till date for BI and analytics

- Compliance verification of all details being automated

- Automatic re-calibration of RPA bots according to application upgrades

- Unattended ML models to self optimize the automation processes

Results

Overall, our client achieved high ROI with financial process automation.

Key Benefits Achieved:

Download PDFKey Benefits Achieved:

- Reduction of manual errors and optimized financial processes!

- Annual savings increased by 130%

- 50% reduction in effort which is equivalent to 30 FTEs

- Improved TAT (Turnaround time)

- 20 different processes were automated using 15 RPA bots

- Average of 20% fewer efforts per process recorded

- Digital log files (Audit Trail) of all activities which reduced compliance risks